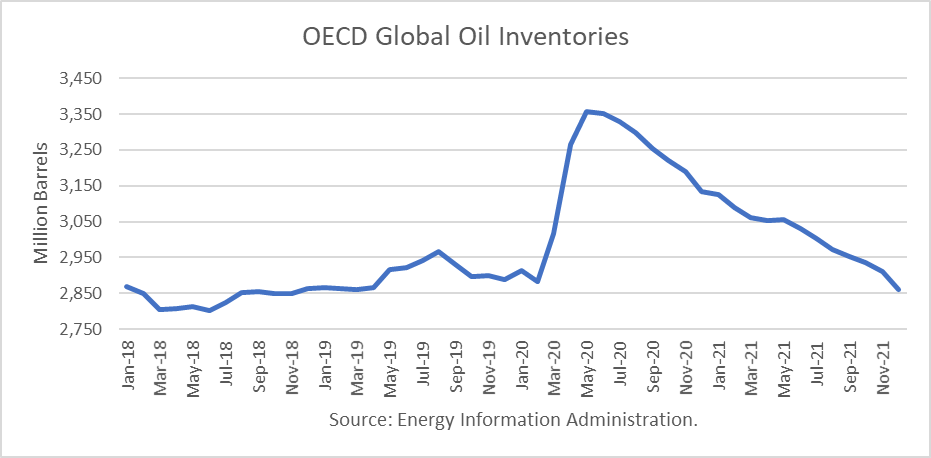

The Energy Information Administration released its Short-Term Energy Outlook for June, and it shows that OECD oil inventories likely bottomed June 2018 at 2.802 billion barrels. It estimated stocks built by 94 million barrels in May to end at 3.358 billion, 442 million barrels higher than a year ago.

For 2020, OECD inventories are projected to build by 243 million barrels to 3.133 billion. For 2021 it forecasts that stocks will draw by 273 million barrels to end the year at 2.860 billion.

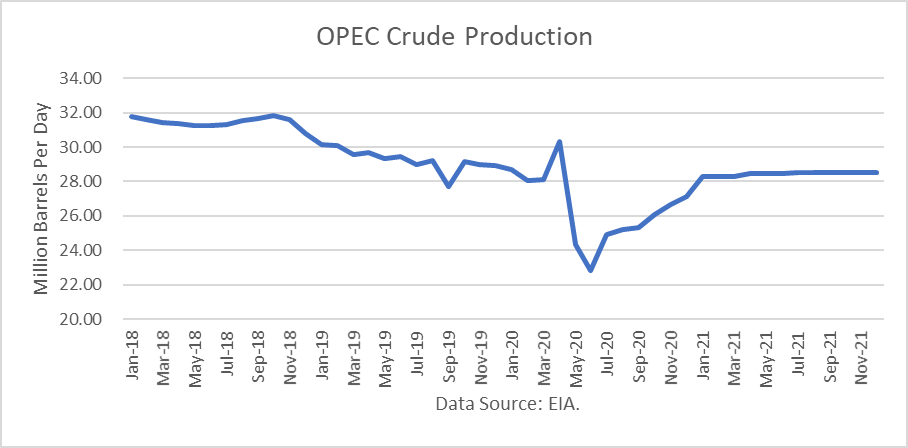

The EIA forecast was made after the OPEC+ decision to cut production and exports. According to OPEC’s press release:

"Adjust downwards their overall crude oil production by 9.7 mb/d, starting on May 1st, 2020, for an initial period of two months that concludes on June 30th, 2020. For the subsequent period of 6 months, from July 1st, 2020 to December 31st, 2020, the total adjustment agreed will be 7.7 mb/d. It will be followed by a 5.8 mb/d adjustment for a period of 16 months, from January 1st, 2021, to April 30th, 2022. The baseline for the calculation of the adjustments is the oil production of October 2018, except for the Kingdom of Saudi Arabia and The Russian Federation, both with the same baseline level of 11.0 mb/d. The agreement will be valid until April 30th, 2022; however, the extension of this agreement will be reviewed during December 2021."

The EIA's storage forecast is based on the assumed level of OPEC production, as depicted below.

Oil Price Implications

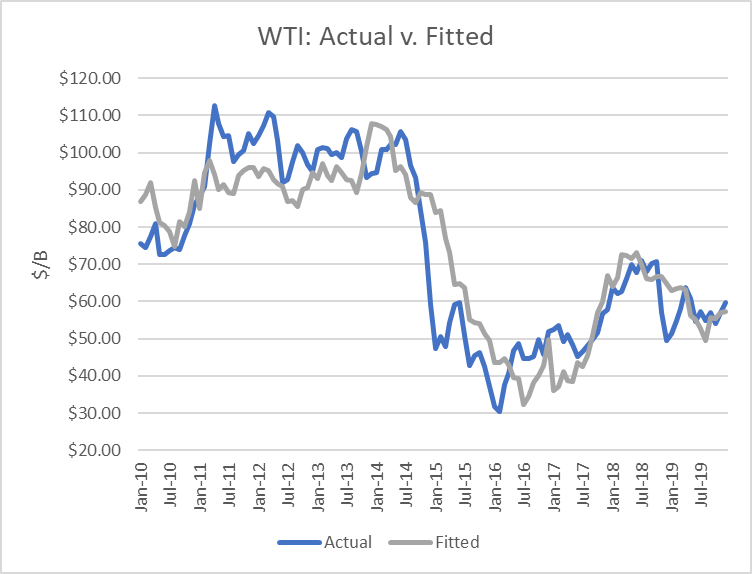

I updated my linear regression between OECD oil inventories and WTI crude oil prices for the period 2010 through 2019. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 79 percent.

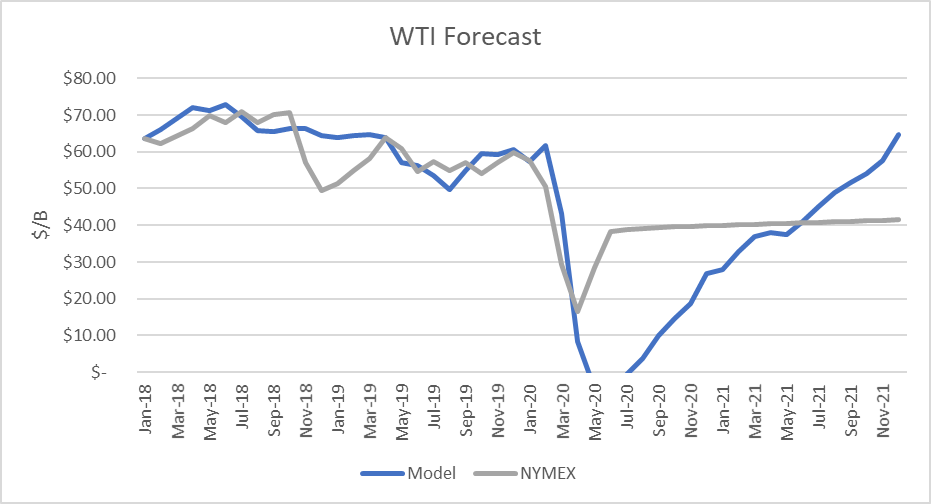

I used the model to assess WTI oil prices for the EIA forecast period through 2020 and 2021 and compared the regression equation forecast to actual NYMEX futures prices as of June 9th. The result is that oil futures prices are presently overvalued for the forecast horizon through June 2021. The model predicts oil prices would return to the trading range prior to the pandemic by late 2021 under EIA’s supply/demand assumptions.

Uncertainties

The 4Q18 proved that oil prices can move dramatically based on expectations and that they can drop far below the model’s valuations. The attack on Aramco’s oil facilities also proved they can rise above the model-derived price, as did the days following the killing of the Iranian general.

Global oil demand and supply estimates remain highly uncertain. No one knows how successful the opening of the economy will be relative to containing the spread of the coronavirus nor what percentage of jobs will remain lost. For example, Arizona is cautioning that it might have to issue new stay-at-home orders because cases are rising once again. New York is only just beginning to loosen restrictions, and protests in many cities do not adhere to social distancing.

At the same time, OPEC’s production agreement lacked any specificity as to how they will be attained. They did not reach their targets in May. And we know that many oil fields would be permanently damaged, for example in Russia, if they are shut-in. And so it is highly suspect that they will be.

Finally, U.S. shale producers say they can restore shut-in production in a week or two and that it makes sense to do so in the $30s. Furthermore, in the United States, where bankruptcy law can be used, shale companies can keep pumping after filing. The assets do not disappear.

Longer-term, it is unknown if and when effective treatments and vaccines will be proven and utilized on a mass scale. Until that happens, oil consumption for transportation use will likely be adversely impacted.

Conclusions

The effects demand destruction and oversupply have been reported in the U.S. weekly statistics. Although demand appears to have bottomed, the economy is in a recession, and the scope for more government stimulus is becoming limited.

Certain trends, such as work from home and Zoom meetings, seem likely to be embedded. This is almost certain to reduce future business travel by car or plane, which accounts for the bulk of petroleum use.

The rebound in oil prices seems to be baking-in an almost robust recovery in the economy and oil demand. I remain skeptical of such beliefs without more tangible evidence.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Very interested in your view on oil prices and how the virus will be effecting the future s