google images=world+oil+production+forecasts Peak oil is defined as the point in time when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline. Forecasts vary widely for future world oil production.

http://www.peakoil.net/uhdsg/weo2004/TheUppsalaCode.html

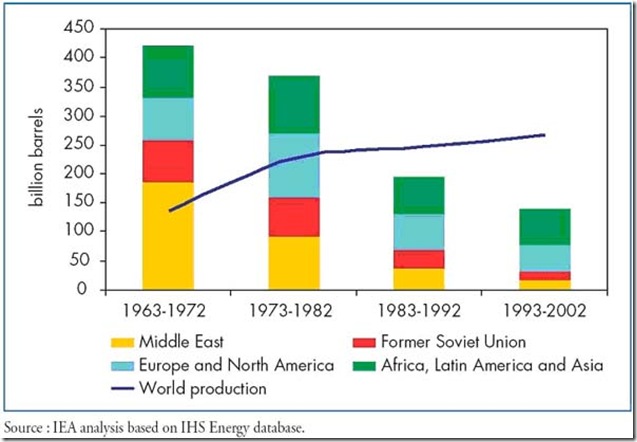

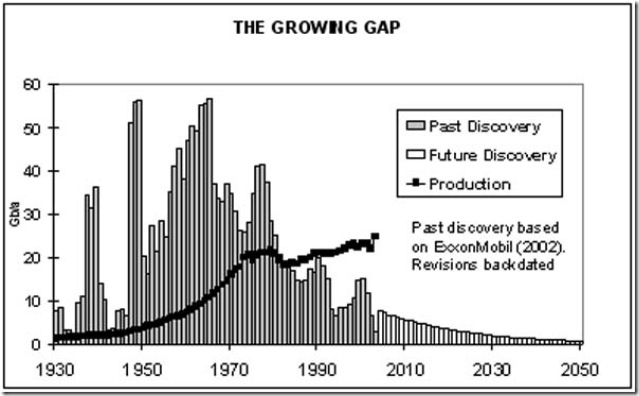

The bulk of the World’s oil lies in these giant fields. Since the world has now been very thoroughly explored, it is inconceivable that a dramatic change in the trend will occur in the 21st Century. The decline in discovery has been relentless for decades, being also depicted by the IEA in the following figure. Plotting the discovery trend per decade on a logarithmic scale, allows extrapolation into the future, clearly demonstrating that 300 Gb will not be found during the next 30 years. A more plausible estimate is between 150 and 200 Gb. It is evidently difficult for the IEA to accept the obvious truth that most of the World’s oil has been found. It tries instead to blame the oil companies and producing countries with large reserves to for not trying hard enough. “According to BP, reserves increased dramatically in the 1980s and 1990s, from 670 billions barrels at the end of 1960 to 1147 billion barrels at the end of 2003 (Figure 7). But most of the increase occurred in OPEC countries, mainly in the Middle East, in the second half of the 1980s. Saudi Arabia and Kuwait revised their reserves upward by 50%, while Venezuelan reserves were boosted 57% by the inclusion of heavy oil in 1988. The United Arab Emirates and Iraq also recorded large upward revisions in that period. Total OPEC reserves jumped from 538 billion barrels in 1985 to 766 billion barrels in 1990. As a result, world oil reserves increased by more that 30%. This hike in OPEC countries’ estimates of their reserves was driven by negotiations at that time over production quotas, and had little to do with the actual discovery of new reserves. In fact, very little exploration activity was carried out in those countries at that time. Total reserves have hardly changed since the end of the 1980s.”

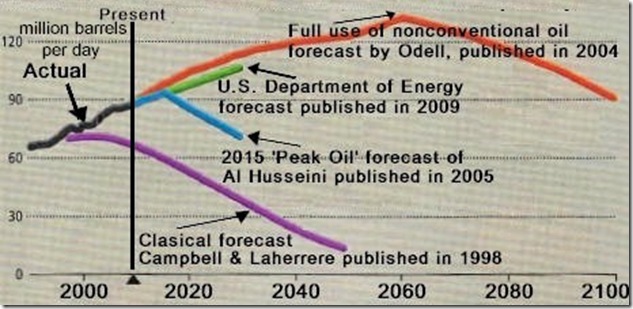

There is a strong correlation between oil demand and GDP growth, save during the 1970s and 1980s, when most of the world’s nuclear power plants come into operation reducing the demand for oil to fuel electricity generation. When the increase of nuclear power was phased out in many countries, oil demand accordingly grew by about two percent to offset the decline of nuclear power and deliver the required growth of GDP. The current study is presents of modest rate of economic growth at 1.6 percent a year. Starting from 77 Mb/d (million barrels a day) in 2002, this rate of increase means that production would have to rise to 121 Mb/d by 2030. Politically, it is not possible for the IEA to present an outlook contemplating less.

Let us evaluate how plausible such a forecast might be. In 2002, the World produced 77 Mb/d or 28 Gb/a (billion barrels per year), which has to rise under the IEA forecast to 44 Gb/a in 2030. It implies that total production from 2003 until 2030 will amount to 1020 Gb. That is more than was consumed during the 20th Century, and is in the same order of magnitude as the existing reserves. It does not sound plausible. In conclusion, the Outlook illustrates its forecast of future production in the next Figure:

http://madisonaveresearch.com/peakoil2010.htm

The EIA, the statistics arm of the US Department of Energy recently released its International Energy Outlook (IEO) for 2010. And what does it say? That peak oil is all but on us. And that’s new. As recently as 2007, the EIA saw a rosy future of oil supplies increasing with demand. It predicted oil consumption would rise by 15 million barrels per day (mbpd) to 2020, an ample amount to cover most eventualities. By 2030, the oil supply would reach nearly 118 mbpd, or 23 mbpd more than in 2006. But over time, this optimism has faded, with each succeeding year’s forecast lower than the year before. For 2030, the oil supply forecast has declined by 14 mbpd in only the last three years. This drop is as much as the combined output of Saudi Arabia and China.

But that’s not the interesting part. The more salient development is the reduction in the forecast to 2020. Forecasts beyond ten years are highly uncertain and more subject to massaging and ‘interpretation’. Shorter term forecasts are more definite, and the forecasters are more accountable. As a consequence, the outlook for the short to medium term warrants greater attention. In the case of the EIA, the forecast changes most dramatically here.

For the remainder of the decade, even though China would be expected to hit its stride for increased oil demand, the EIA sees no year in which liquids production will increase by even 1%. Petroleum liquids supply increases by an average of 0.6% per year from 2011 to 2020. In other words, the EIA is expecting the oil supply to be essentially flat for the rest of the decade. The supply will creep up from 86 mbpd today to approximately 92 mbpd to 2020, but that is not much growth, and indeed, is about the same as current global liquids production capacity. Moreover, it represents a reduction of nearly 4 mbpd from last year’s forecast for 2020. On paper, the output of China has disappeared over the course of the last year.

In its forecast, the EIA, normally the cheerleader for production growth, has become amongst the most pessimistic forecasters around. For example, its forecasts to 2020 are 2-3 mbpd lower than that of traditionally dour Total, the French oil major. And they are below our own forecasts at Douglas-Westwood through 2020. As we are normally considered to be in the peak oil camp, the EIA’s forecast is nothing short of remarkable, and grim. Is it right? In the last decade or so, the EIA’s forecast has inevitably proved too rosy by a margin. While SEC-approved prospectuses still routinely cite the EIA, those who deal with oil forecasts on a daily basis have come to discount the EIA as simply unreliable and inappropriate as a basis for investments or decision-making. But the EIA appears to have drawn a line in the sand with its new IEO and placed its fortunes firmly with the peak oil crowd. At least to 2020. We’ll see how it plays out. But for now, the EIA appears to be making a statement. Perhaps we should sit up and pay attention.

Pingback: Two Trends for 2011: Declining Saudi Oil Production and China’s Aging Population